How I Keep My Cool and My Cash: Raising Kids Without Financial Panic

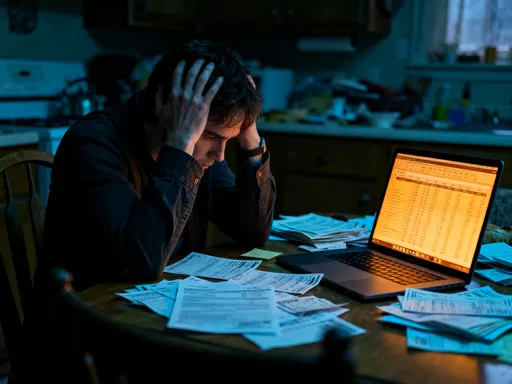

Ever feel like your wallet empties faster than your kids’ juice boxes? Raising multiple children doesn’t have to mean constant money stress. I’ve been there—overspending on "must-have" gear, impulse buys at checkout lanes, and saying yes too often. But over time, I discovered simple, real-world financial skills that actually work. This is not about extreme budgeting or perfection. It’s about practical strategies that protect your peace, grow your savings, and keep your family financially steady—without burning out.

The Real Cost of Raising Multiple Kids – And What Most Parents Miss

Raising more than one child introduces a complex financial reality that extends far beyond doubling the cost of diapers and daycare. While many parents anticipate increased spending on food, clothing, and education, fewer recognize how the structure of a multi-child household creates unique financial pressures that compound over time. Each child enters different life stages at different times, leading to overlapping yet staggered expenses—such as one child needing braces while another starts high school and a third enters preschool. These non-synchronized milestones create a continuous cycle of spending that can strain even well-managed budgets.

One often-overlooked factor is the psychological pressure to treat each child equally, financially. This desire for fairness frequently leads parents to duplicate purchases—buying the same branded sneakers for each child or enrolling all in the same costly extracurriculars—even when budgets can’t support it. The result is not just higher spending, but a subtle erosion of financial control. Additionally, social dynamics amplify expenses: sibling peer pressure, school-related social expectations, and the visibility of other families’ spending habits can push parents toward choices they might otherwise avoid.

Another hidden cost lies in the logistics of managing multiple schedules. Transportation becomes a major expense, especially when activities are spread across different parts of town or require separate drop-offs and pickups. The time and fuel costs add up quickly, and many families end up relying on ride-sharing or second vehicles without fully accounting for the long-term financial impact. Even something as simple as school supply shopping becomes more expensive when repeated for multiple grade levels, with each list containing unique, non-shared items.

What most parents fail to plan for is the absence of true economies of scale. While some items—like household groceries or streaming subscriptions—can be shared, many child-related costs do not decrease per person with more children. In fact, the opposite often occurs: the more children, the more appointments, forms, fees, and administrative overhead a family must manage. This constant financial motion can create a sense of perpetual scarcity, even when income is stable. Recognizing these patterns is the first step toward regaining control. Awareness allows parents to shift from reactive spending to intentional planning, laying the foundation for a more sustainable financial path.

Budgeting That Actually Fits a Chaotic Family Life

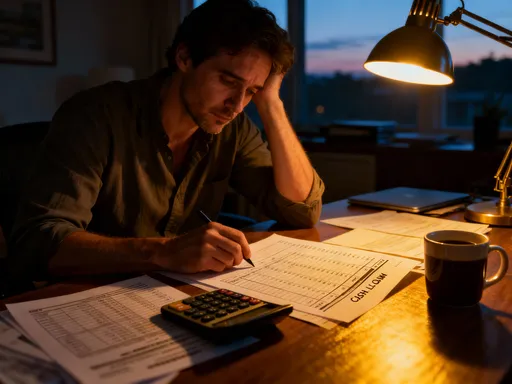

Traditional budgeting methods often fall short in multi-child households because they assume predictability, consistency, and time—three things most busy parents lack. A rigid monthly spreadsheet that demands daily updates may work for a single professional, but it’s unrealistic for a parent juggling school runs, work shifts, and after-school activities. The key to effective budgeting in a chaotic family environment isn’t precision—it’s flexibility, resilience, and simplicity. A successful family budget must be able to absorb surprises without collapsing, adapt to changing needs, and remain easy to follow even during the busiest weeks.

A more practical approach focuses on core spending zones rather than itemized line items. These zones—such as essentials (housing, utilities, groceries), health (insurance, medications, check-ups), education (supplies, field trips, tutoring), and transportation (gas, maintenance, public transit)—serve as broad categories that capture the majority of family expenses. Within each zone, a realistic monthly range is set based on past spending patterns, not idealized goals. For example, the grocery budget might be set between $600 and $800 per month, allowing for fluctuations due to seasonal prices, sales, or unexpected guests.

Digital tools can support this flexible system without requiring constant attention. Apps that automatically categorize transactions and send low-balance alerts help parents stay informed without manual tracking. Some families use a modified envelope method digitally, allocating funds to virtual “envelopes” for each spending zone and transferring money as needed. This approach provides visibility and control while reducing the mental load of daily budgeting. The goal is not to eliminate overspending entirely but to contain it within manageable limits and prevent it from derailing long-term financial goals.

Another crucial element is aligning the budget with family values. When financial decisions reflect what matters most—whether it’s education, health, or family time—spending feels more intentional and less stressful. For instance, a family that values travel might allocate more to transportation and less to dining out. A family prioritizing education might invest in learning resources while cutting back on entertainment. These choices reduce guilt and increase satisfaction, making the budget a tool for empowerment rather than restriction. When children understand that money is directed toward what the family values, they are more likely to accept limits on less important items.

Finally, sustainability means building in breathing room. A budget with no margin for error will fail the first time a child needs new shoes before payday or a last-minute birthday gift is required. By including a small “flex fund” for unexpected expenses—funded gradually over time—families can handle surprises without panic. This fund acts as a financial cushion, reducing the need to borrow or dip into savings. The result is a budget that survives real life, not just spreadsheet theory.

Smart Spending: Where to Cut Without Causing Family Drama

Reducing household spending doesn’t have to mean sacrificing quality of life or creating tension at home. In multi-child families, the goal isn’t austerity—it’s strategic decision-making that preserves both financial stability and family harmony. The most effective cost-saving measures are those that go unnoticed or are embraced as part of family culture. These include reusing clothing and gear, shopping in bulk with discipline, and making thoughtful choices about extracurricular activities.

One of the most impactful strategies is establishing a hand-me-down system. Children grow quickly, and high-quality clothing, shoes, and outerwear can often be passed from one sibling to the next. With proper care and storage, these items retain both function and appearance, significantly reducing the need for new purchases. Families can extend this practice beyond their own homes by organizing small clothing swaps with trusted friends or community groups. This not only saves money but also teaches children about sustainability and resourcefulness.

Grocery spending is another major area where smart habits yield real savings. While bulk buying can be effective, it only works when paired with meal planning and storage discipline. Purchasing large quantities of perishable items without a clear plan often leads to waste, negating any initial savings. A better approach is to identify non-perishable staples—such as rice, pasta, frozen vegetables, and canned goods—that can be bought in bulk and used consistently. Additionally, shopping later in the day when stores mark down perishables, using digital coupons, and sticking to a list can reduce impulse purchases at checkout.

When it comes to extracurricular activities, many families fall into the trap of over-scheduling. Each child may want to try soccer, dance, music lessons, or art classes, but the cumulative cost can be staggering. A more sustainable model is to limit each child to one or two activities per season, rotating based on interest and budget availability. This approach allows children to explore their passions without overwhelming the family schedule or finances. It also opens opportunities for free or low-cost alternatives, such as community parks programs, school-based clubs, or family-led learning projects.

Teaching children to participate in cost-saving decisions can turn financial limits into positive experiences. For example, letting older children help plan a weekly menu within a set budget gives them agency and practical math skills. Similarly, involving them in choosing between two equally appealing but differently priced items teaches comparison shopping and trade-offs. When children feel included in the process, they are less likely to resent spending limits and more likely to develop lifelong financial awareness.

It’s also important to avoid false economies—choices that seem cheap in the short term but cost more over time. Buying low-quality shoes that wear out in weeks, for instance, ends up being more expensive than investing in durable pairs that last. The same applies to appliances, electronics, and even groceries: sometimes paying a little more upfront saves money in repairs, replacements, or health consequences later. Smart spending means evaluating total cost of ownership, not just the price tag at purchase.

Earning More Without Losing Your Sanity

For many families with multiple children, increasing income becomes a necessary step toward financial stability. However, the idea of “hustling harder” often leads to burnout, especially when parenting responsibilities are already overwhelming. The goal should not be to work more at all costs, but to find realistic, sustainable ways to boost household earnings without sacrificing health, relationships, or peace of mind. This requires a thoughtful approach that balances opportunity with energy, time, and family needs.

One of the most accessible paths is part-time remote work, particularly in roles that align with existing skills. Many companies now offer flexible positions in customer service, data entry, virtual assistance, or tutoring. These jobs often allow parents to work during nap times, after bedtime, or on weekends, fitting around family schedules. The key is to seek roles with clear boundaries—fixed hours, predictable workloads, and no expectation of constant availability. This prevents work from spilling into family time and maintains a sense of control.

Skill-based side gigs are another viable option. Parents with expertise in areas like writing, graphic design, baking, sewing, or home organization can offer services locally or online. Platforms exist to connect freelancers with clients, but even word-of-mouth referrals within a community can generate steady income. The advantage of skill-based work is that it often feels more rewarding than generic jobs, and rates can be higher due to specialized knowledge. Setting realistic goals—such as earning an extra $200–$500 per month—keeps expectations manageable and reduces pressure.

For couples, discussing and balancing earning roles is essential. In some families, one parent may take on more income-generating work while the other manages home and childcare. In others, both contribute part-time earnings. What matters most is fairness and communication. Regular financial check-ins allow couples to assess what’s working, adjust responsibilities, and ensure neither partner feels overburdened. This collaboration strengthens both the relationship and the household economy.

Occasionally, a career shift may offer better long-term financial prospects. This doesn’t always mean going back to school or starting over—it could involve transitioning to a higher-paying industry, seeking certifications that increase earning potential, or moving into supervisory roles. Such changes require planning and support, but they can lead to more stable, better-compensated work that reduces long-term financial stress. The decision should be made jointly, with consideration for how it affects family life, childcare arrangements, and emotional well-being.

The guiding principle is sustainability. Earning more should not come at the cost of health, sleep, or family connection. A parent who is constantly exhausted or absent may earn more money but lose what matters most. The goal is not maximum income, but sufficient, stable earnings that support the family without requiring sacrifice beyond reason. When additional income is earned with intention and balance, it becomes a tool for freedom, not fatigue.

Teaching Kids Money Smarts Early—Without the Lecture

Financial literacy doesn’t require formal lessons or textbooks. In a multi-child household, everyday moments offer rich opportunities to teach money skills in a natural, low-pressure way. The goal is not to lecture, but to model, involve, and guide—turning routine activities into real-life financial education. When children learn about money through experience, they develop habits that last far longer than any classroom lesson.

Grocery shopping, for example, becomes a powerful teaching tool when children are invited to compare prices, calculate unit costs, or stay within a snack budget. A simple question like “Which cereal gives us more for the money?” introduces basic economic thinking. Similarly, letting children help plan a meal using sale items teaches resourcefulness and creativity. These experiences build confidence and competence, making money feel less mysterious and more manageable.

Saving for desired items is another effective lesson. Instead of automatically buying every toy or game a child wants, parents can encourage saving a portion of birthday money or allowance toward the purchase. This practice teaches delayed gratification, goal-setting, and the satisfaction of earning something through patience. Some families use clear jars to visualize progress, making the abstract concept of saving tangible and motivating.

Charitable giving can also be introduced early. Allowing each child to donate a small portion of their money—whether to a school fundraiser, animal shelter, or community project—fosters empathy and responsibility. It shows that money has power beyond personal consumption and that families can make a difference together. This shared value strengthens family identity and purpose.

Sibling dynamics can enhance financial learning. Older children can mentor younger ones in budgeting or help manage a shared “family fund” for outings. Siblings might even collaborate on small home businesses—like a lemonade stand or handmade crafts—learning teamwork, pricing, and customer service. These projects build not only financial skills but also communication and cooperation.

The key is consistency and patience. Financial understanding grows gradually, through repeated exposure and gentle guidance. Parents don’t need to be experts—only present, intentional, and willing to talk openly about money. When children see their parents making thoughtful choices, discussing trade-offs, and planning for the future, they absorb those values by example. Over time, these small moments add up to lasting financial wisdom.

Protecting Your Family from Financial Shocks

No matter how careful a family is, unexpected events will happen. A car breaks down, a job is lost, or a medical issue arises. For families with multiple children, these shocks can be especially disruptive, as fixed costs remain high while income may drop. The difference between panic and resilience lies in preparation. Building financial safeguards isn’t about fear—it’s about creating stability that allows a family to weather storms without long-term damage.

The foundation of this protection is an emergency fund. While general advice often suggests three to six months of expenses, families with more children may need a larger cushion due to higher fixed costs. A more realistic target is to save enough to cover essential expenses—housing, food, utilities, insurance—for at least three months. This fund should be kept in a separate, easily accessible account, not mixed with everyday spending. Contributions can start small—even $20 per week adds up over time—and grow as the family’s financial situation improves.

Insurance is another critical layer of protection. Health insurance, auto insurance, and home insurance are non-negotiable, but families should also consider disability insurance, especially if one income supports multiple dependents. Life insurance may also be necessary to ensure children are cared for in the event of a parent’s death. These policies are not about expecting the worst—they are about ensuring continuity and security for the family’s future.

Debt avoidance is equally important. High-interest credit card debt can quickly spiral out of control, especially when used to cover emergencies. Families should aim to live within their means and use credit sparingly. If debt exists, a clear repayment plan should be prioritized. Avoiding new debt during stressful times prevents compounding financial pressure.

Finally, creating a “financial fire drill” plan helps the family respond calmly when crises occur. This plan outlines steps to take in different scenarios—such as how to reduce spending, access emergency funds, or find temporary income. Knowing what to do in advance reduces decision fatigue during emergencies and increases confidence. Practicing this plan annually, like a fire drill, ensures everyone is prepared.

Building Long-Term Wealth, One Practical Step at a Time

Wealth is not the result of a single lucky break, but of consistent, informed choices made over time. For families with multiple children, building long-term financial security may seem daunting, but it is entirely achievable through disciplined, practical steps. The focus should not be on getting rich quickly, but on steady progress—contributing to retirement accounts, saving for education, and developing habits that grow assets over decades.

Retirement savings should remain a priority, even when current expenses feel overwhelming. Many employers offer matching contributions to 401(k) plans, which is essentially free money. Maximizing this match, even with small contributions, lays the foundation for future security. Individual retirement accounts (IRAs) offer another avenue for growth, especially for self-employed parents or those without workplace plans. The power of compound interest means that even modest, regular contributions can grow significantly over time.

Education savings is another key area. While college is not the only path, having funds set aside provides options. A 529 plan allows tax-advantaged growth for qualified education expenses and can be used for trade schools, community colleges, or universities. Contributions don’t have to be large—starting with $25 or $50 per month per child creates momentum. Relatives can also contribute, turning birthdays and holidays into opportunities to grow the fund.

Simple asset-building habits reinforce long-term success. These include paying bills on time to maintain good credit, avoiding unnecessary debt, and reviewing financial goals annually. Families can also explore low-risk investment options, such as index funds, which offer broad market exposure with low fees. The goal is not to time the market, but to stay in it—consistently investing over time regardless of short-term fluctuations.

When financial decisions become overwhelming, seeking professional advice can provide clarity. A fee-only financial planner can help create a customized roadmap without pushing products or commissions. This guidance is especially valuable during major life changes, such as a new child, job loss, or home purchase.

Finally, avoiding financial fads is crucial. Trends like cryptocurrency speculation or get-rich-quick schemes often promise high returns but carry extreme risk. For families focused on stability, these are not viable strategies. True wealth is built slowly, through patience, planning, and protection of what has been earned. By staying focused on long-term goals, multi-child families can achieve financial peace—not overnight, but one practical step at a time.