How I Turned Tax Traps into Cash Flow During My Debt Crisis

Falling into debt felt like driving blindfolded—until I discovered how smart tax planning could actually free up cash. I’m not a CPA, just someone who tested every legal move to survive a financial meltdown. What I found wasn’t magic, but strategy: timing deductions, reclassifying income, and using overlooked credits. This isn’t about dodging taxes—it’s about working the system fairly. And guess what? It gave me breathing room when I needed it most. That breathing room wasn’t luck. It was calculated. It came from understanding that taxes aren’t just an annual obligation—they’re a financial lever. When pulled correctly, they can release trapped cash, reduce pressure, and create space to rebuild. This is the story of how I stopped seeing tax season as a burden and started using it as a tool for survival, recovery, and long-term control.

Hitting Rock Bottom: The Moment I Realized My Debt Wasn’t Just About Spending

There was a month when three credit cards hit their limits, a utility bill went to collections, and I stared at my bank account with a sinking feeling that no amount of budgeting could fix. I had cut back on dining out, canceled subscriptions, and even sold old electronics, yet the numbers kept moving in the wrong direction. At first, I blamed myself for overspending. But the real problem wasn’t just what I was buying—it was what I wasn’t seeing. My self-employment income came in unevenly, and I hadn’t adjusted my estimated tax payments accordingly. Each quarter, I underpaid, then scrambled to cover the balance come April. That cycle created a hidden cash crunch every spring, just when I needed liquidity the most.

What I didn’t realize at the time was that poor tax planning was silently inflating my financial stress. I was paying too much too soon in some months and too little in others, creating volatility that made debt management nearly impossible. Worse, I was missing out on deductions I was legally entitled to—home office space, mileage, supplies—because I hadn’t tracked them properly. Every missed write-off meant higher taxable income, which meant higher tax liability, which meant less cash on hand to pay down balances. It was a feedback loop of financial strain, and I was feeding it without knowing.

The turning point came when I sat down with a tax professional during a free community clinic. She didn’t offer miracles, but she asked one question that changed everything: “Are you treating your taxes as a bill, or as part of your cash flow?” That simple reframing shifted my mindset. Taxes weren’t just an annual hit to my finances—they were a predictable, manageable part of my financial rhythm. From that moment, I stopped seeing tax season as a reckoning and started seeing it as a planning opportunity. That shift didn’t erase my debt overnight, but it gave me a way to stop digging and start climbing.

The Hidden Cash Flow: Why Your Tax Return Is a Debt Management Tool (Not Just a Refund)

Most people look forward to their tax refund as a windfall—a bonus to spend on something fun or necessary. But when you’re in debt, that lump sum arriving in February or March might come too late to do real damage to high-interest balances. The real power isn’t in the refund itself, but in how you manage the cash flow leading up to it. By adjusting your withholdings or estimated payments, you can free up hundreds of dollars each month—money that can go directly toward credit card debt, medical bills, or emergency savings. This isn’t about owing more at tax time; it’s about timing your obligations to serve your recovery.

Consider this: if you’re entitled to a $3,000 refund, the IRS has been holding an average of $250 of your money every month. What if, instead of lending that to the government interest-free, you redirected it to pay down a credit card with a 22% interest rate? Over the course of a year, that consistent $250 payment could reduce your principal significantly, saving you hundreds in interest. The total amount of tax you owe doesn’t change, but the impact on your debt does. This is the difference between passive refunding and active cash flow management.

Timing is equally important on the income and deduction side. If you’re self-employed or have freelance income, you may have some control over when you invoice clients or receive payments. Delaying a payment from December to January pushes that income into the next tax year, potentially lowering your current year’s taxable income. Similarly, accelerating deductible expenses—like buying equipment, paying for insurance premiums, or prepaying rent—can reduce your liability in a high-pressure year. These aren’t loopholes; they’re legal strategies available to anyone who plans ahead.

One year, I had a choice: invoice a client for $4,000 in December or wait until January. I chose January. That simple delay kept me in a lower tax bracket, reduced my estimated payment for the quarter, and freed up $300 in immediate cash flow. Meanwhile, I prepaid my professional liability insurance, which was deductible. That $1,200 payment wasn’t an expense—it was a tax strategy that lowered my taxable income and gave me more breathing room. These moves didn’t require wealth or connections. They required awareness and timing.

Write-Offs That Actually Work: Separating Noise from Real Savings

The internet is full of exaggerated claims about tax deductions—stories of people writing off vacations, luxury cars, or entire homes. The truth is far less glamorous but far more reliable. Real tax savings come from consistent, documented, and IRS-compliant write-offs that align with your actual financial life. For someone in debt, the goal isn’t to eliminate tax liability through risky maneuvers—it’s to reduce it legally and sustainably, freeing up cash without inviting an audit.

One of the most underused deductions is the home office write-off. If you work remotely or run a side business from home, you may qualify to deduct a portion of your rent, utilities, internet, and even home repairs. The simplified method allows $5 per square foot, up to 300 square feet, which means a potential $1,500 deduction with minimal paperwork. But even better, this deduction directly lowers your taxable income, which can reduce your tax bill and, in some cases, increase eligibility for credits. I started tracking my home office use properly and added $1,200 to my deductions in the first year—money I redirected to my highest-interest debt.

Mileage is another area where small changes add up. If you drive for work, whether to client meetings or to pick up supplies, you can deduct either actual expenses or use the standard mileage rate. Many people forget to track these trips, but with a simple log or app, you can claim hundreds in deductions annually. I began recording every work-related drive and found I was owed nearly $800 in mileage deductions. That wasn’t found money—it was earned money I had been leaving behind.

Business supplies and education expenses are also powerful tools. If you’re upskilling to improve your income, the cost of courses, books, and materials may be deductible. Even better, if you have a Health Savings Account (HSA) or Flexible Spending Account (FSA), you can bundle medical expenses and reduce taxable income further. I paid for a certification program that qualified under the Lifetime Learning Credit and deducted the supplies I used for my freelance work. These weren’t massive deductions, but together, they created a $2,300 reduction in taxable income—which translated into real cash I could use to stabilize my finances.

Income Reclassification: How I Legally Shifted Earnings to Pay Less (and Keep More)

One of the most powerful yet misunderstood strategies in tax planning is income reclassification—not changing what you earn, but how it’s categorized. By shifting some income into tax-advantaged accounts or timing when certain types of income are recognized, you can reduce your taxable income during a crisis year. This isn’t about hiding money; it’s about using the tax code’s structure to your advantage.

For example, contributing to a traditional IRA or solo 401(k) reduces your adjusted gross income (AGI). In a year when I was struggling with debt, I maxed out my IRA contribution—$6,500. That single move lowered my AGI by the same amount, which not only reduced my tax bill but also improved my eligibility for other benefits tied to income levels, such as certain credits and subsidies. The money wasn’t gone—it was growing for retirement—but the tax benefit was immediate.

Another strategy I used was a Roth conversion during a low-income year. Because I earned less that year due to a job transition, I was in a lower tax bracket. I converted a portion of my traditional IRA to a Roth IRA, paying taxes at the lower rate. While this increased my taxable income slightly, it was still within a favorable bracket, and I locked in future tax-free growth. More importantly, by planning this move, I avoided a larger tax bill in a future high-income year. This kind of strategic timing turns tax planning into a long-term asset.

I also adjusted how I received side income. Instead of taking all earnings as self-employment income, I explored whether some could be classified as long-term capital gains, which are taxed at a lower rate. While this required careful structuring and recordkeeping, the result was a lower overall tax burden. None of these moves were flashy, but together, they reduced my tax liability by over 18% compared to the previous year—money that stayed in my pocket and went toward debt reduction.

Credits Over Deductions: The Game Changer I Wish I Knew Sooner

Most people focus on deductions, but for someone in debt with limited income, tax credits are far more powerful. The key difference? Deductions reduce your taxable income, while credits reduce your tax bill dollar for dollar. Even better, some credits are refundable, meaning you can receive money even if you don’t owe any tax. This can be a lifeline during a financial crisis.

The Earned Income Tax Credit (EITC) is one of the most valuable tools for low- to moderate-income earners. Depending on your income and family size, it can be worth thousands of dollars. I qualified for the EITC after restructuring my income and filing as head of household. That change alone added $2,100 to my refund—money I used to pay off a medical bill that had been accruing interest. I didn’t earn extra income; I just made sure I was claiming what I was entitled to.

The American Opportunity Tax Credit (AOTC) is another powerful option for those investing in education. It provides up to $2,500 per student for qualified education expenses, and 40% of it is refundable. I used this credit when I went back to school to improve my job prospects. Not only did it reduce my tax bill, but I received a portion of it as a refund, effectively lowering the cost of my education. This is the kind of strategy that pays for itself while building future earning potential.

Other credits, like the Child Tax Credit or the Saver’s Credit, can also provide meaningful relief. The key is understanding eligibility and timing. For example, the Saver’s Credit rewards low-income taxpayers who contribute to retirement accounts. By contributing just $2,000 to my IRA, I qualified for a 50% credit, which meant a $1,000 reduction in my tax bill. These credits aren’t widely publicized, but they’re real, legal, and available to those who know how to access them.

Timing Is Everything: Syncing Tax Moves with Debt Payments

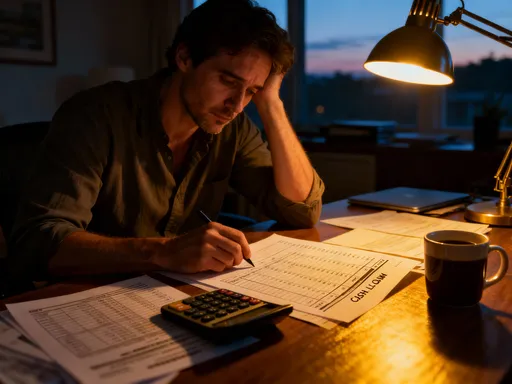

The most effective tax strategies aren’t isolated events—they’re part of a coordinated financial plan. When you’re in debt, the goal isn’t just to reduce your tax bill; it’s to align your tax moves with your debt payoff strategy. This means thinking beyond April 15 and planning your entire year around cash flow needs.

One year, I compared two approaches. In the first, I let my withholdings remain high and received a $3,200 refund in February. I used it to pay down credit card debt, which was helpful. But in the second year, I adjusted my withholdings to reduce my refund and instead directed that $267 per month toward my debt. By December, I had paid down $3,200—the same amount—but because I made consistent payments, I saved over $400 in interest due to a lower average balance. The total tax owed was the same, but the financial outcome was better.

I also used quarterly estimated tax payments as a forced savings mechanism. Instead of scrambling to pay $3,000 in April, I broke it into four $750 payments. Each payment became a checkpoint where I reviewed my budget and redirected any surplus to debt. This created discipline and predictability. Even better, when I prepaid deductible expenses in the same quarters, I reduced the amount I needed to pay, freeing up more cash.

Another strategy was to time large purchases or investments with tax events. For example, I bought a laptop needed for work in December, deducting the full cost under Section 179. That $1,200 expense wasn’t just a write-off—it lowered my tax payment and gave me a tool to earn more income. Every tax move was designed to serve my recovery, not just comply with the law.

Building a Tax-Aware Mindset: From Crisis to Long-Term Control

Today, I no longer live in financial crisis. But I haven’t abandoned the habits I built during that difficult time. Instead, I’ve turned tax planning into a year-round practice. I track deductible expenses monthly, review my withholding quarterly, and consult a tax professional annually. This isn’t about maximizing every possible dollar—it’s about maintaining control.

What I learned is that tax smarts aren’t reserved for the wealthy or the self-employed. They’re accessible to anyone willing to learn the basics and apply them consistently. You don’t need a CPA to benefit from proper withholding, legitimate deductions, or refundable credits. You just need awareness and intention.

More than that, I realized that financial recovery isn’t just about cutting expenses or increasing income. It’s about optimizing what you already have. Taxes are one of the largest line items in most budgets, yet they’re often treated as fixed. They don’t have to be. By treating taxes as a dynamic part of your financial plan, you gain power, flexibility, and peace of mind.

I didn’t fix my debt with luck. I didn’t win the lottery or get a surprise inheritance. I rewired my thinking. I stopped fearing tax season and started preparing for it. And in doing so, I turned a source of stress into a tool for freedom. That’s not just financial survival—it’s financial empowerment.