Why Smart Wealth Stays Safe: My Path to Smarter Inheritance Planning

What happens to your wealth when it’s no longer yours to manage? I used to think inheritance was just about wills—until I saw how quickly family assets can unravel without smart planning. It’s not just about who gets what, but how protected that wealth remains. Through trial, error, and real-world lessons, I discovered that diversification isn’t just for investors—it’s the backbone of lasting legacy. This is how I built a system that preserves value, minimizes risk, and passes wealth with purpose.

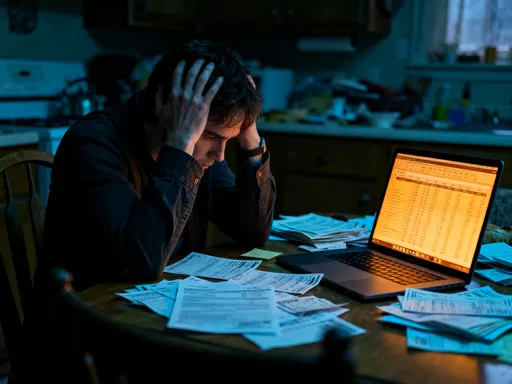

The Hidden Risk in Inheritance: When Wealth Starts to Leak

Inheritance is often treated as a final act—an endpoint where assets are transferred and responsibilities end. But in reality, it marks the beginning of a new financial chapter, one that is vulnerable to erosion if not carefully managed. Many families assume that once a will is signed and an estate settled, the job is done. Yet statistics and experience show that a significant portion of inherited wealth disappears within a generation, not due to extravagance alone, but because of structural weaknesses in how that wealth is held and managed.

One of the most common issues is over-concentration. A family may have built wealth through a successful business, a piece of real estate, or long-held stock in a single company. While these assets may have served the original owner well, passing them on in their current form exposes heirs to outsized risk. If the business declines, the property market dips, or the stock falters, the entire inheritance can be compromised. Without diversification, there is no buffer—no alternative sources of value to stabilize the portfolio when one asset underperforms.

Liquidity is another silent threat. Many estates are rich in assets but poor in cash. When taxes, legal fees, or maintenance costs arise, heirs may be forced to sell valuable property at an inopportune time, often at a loss. This fire-sale scenario turns what should be a source of security into a source of stress. Additionally, emotional decision-making can accelerate the decline. Heirs unfamiliar with financial management may make impulsive choices—investing in risky ventures, over-spending, or failing to maintain assets—simply because they lack guidance or structure.

Market exposure compounds these challenges. In a world of economic cycles, inflation, and geopolitical uncertainty, wealth that isn’t actively protected is inherently at risk. An inheritance that remains static—untouched by rebalancing or strategic oversight—loses purchasing power over time. The combination of concentration, illiquidity, emotional pressure, and market forces creates what financial planners call a “wealth leak”—a slow but steady erosion of value that few anticipate but many experience.

Asset Diversification: More Than Just Spreading Risk

When most people hear the word diversification, they think of spreading money across different stocks or funds. While that is part of it, true diversification in the context of inheritance planning goes much deeper. It’s about creating a resilient financial ecosystem where different types of assets support and balance one another, ensuring that the failure of one component does not jeopardize the whole. This is not a strategy for maximizing returns; it is a strategy for preserving value across decades.

At its core, diversification means avoiding over-reliance on any single asset class, sector, or geographic region. For an inheritance, this translates into a mix of real estate, equities, fixed income instruments, and alternative investments such as private equity, commodities, or even art and collectibles. Each of these plays a distinct role. Real estate can provide steady income and long-term appreciation, equities offer growth potential, fixed income delivers stability and predictable cash flow, and alternatives can serve as hedges against inflation or market volatility.

What makes this approach powerful is how these asset classes interact under different economic conditions. For example, when stock markets decline, bonds often hold their value or even rise. When inflation increases, real estate and commodities tend to perform well. By holding a mix of these, a diversified portfolio is less likely to suffer catastrophic losses during downturns. This doesn’t mean it won’t fluctuate—no portfolio is immune to market movements—but the swings are generally less severe, and recovery is faster.

For heirs, this balance is crucial. Many beneficiaries are not professional investors. They may lack the time, knowledge, or emotional detachment to manage a volatile portfolio. A well-diversified structure reduces the need for constant intervention, making it easier to maintain over the long term. It also provides flexibility. If one asset needs to be sold—perhaps to cover a tax bill or a personal expense—there are options. You don’t have to sell the family home or the business; you can liquidate a portion of a mutual fund or a bond holding instead.

Moreover, diversification is not a one-time act. It requires ongoing review and adjustment. As markets change, so should the portfolio. An inheritance plan that includes regular rebalancing—say, every two to three years—ensures that the original risk profile is maintained. This disciplined approach prevents the portfolio from drifting into dangerous concentrations over time, especially as certain assets grow faster than others.

Designing a Legacy Portfolio: Balancing Growth and Stability

A legacy portfolio is not the same as a retirement portfolio. While both aim to preserve capital, a legacy portfolio must also endure across generations. This means it cannot be overly conservative, nor can it be recklessly aggressive. The goal is a careful balance between growth and stability—one that allows wealth to maintain its purchasing power while minimizing the risk of significant losses.

One effective way to achieve this is through a tiered structure. The foundation of the portfolio consists of low-volatility, income-generating assets such as high-quality bonds, dividend-paying stocks, and rental properties. These provide a steady stream of cash flow that can support beneficiaries’ living expenses or reinvestment needs without requiring the sale of principal. This layer acts as a financial anchor, ensuring that even in difficult times, there is a reliable source of funds.

The second tier focuses on long-term growth. This includes exposure to equities, both domestic and international, as well as select alternative investments. These assets may fluctuate more in the short term, but over decades, they have historically outpaced inflation and delivered meaningful appreciation. The key is to hold them in a disciplined manner—buying with a long horizon in mind and avoiding emotional reactions to market swings.

Geographic and currency diversification are also essential components. In today’s interconnected world, tying all wealth to a single country’s economy is a significant risk. Economic downturns, currency devaluations, or political instability in one nation can have ripple effects on assets held there. By spreading investments across different regions—North America, Europe, Asia, and emerging markets—families can reduce their exposure to any one country’s fate. Similarly, holding assets in multiple currencies can provide a hedge against currency fluctuations, preserving the real value of the portfolio over time.

Transparency and ease of management are equally important. A legacy portfolio should not be so complex that heirs feel overwhelmed. Investments should be straightforward, well-documented, and managed by trusted professionals when necessary. The use of low-cost index funds, exchange-traded funds (ETFs), and professionally managed accounts can simplify oversight while maintaining performance. The goal is not to create a financial puzzle, but a clear, sustainable system that works for generations.

Risk Control: Protecting Against the Unpredictable

Even the most thoughtfully diversified portfolio can be undermined by forces beyond the market. Family conflict, legal disputes, poor decision-making, or unexpected liabilities can all threaten the integrity of an inheritance. This is where risk control becomes essential—not just financial risk, but human and structural risk as well.

One of the most effective tools for managing these risks is the use of legal structures such as trusts and family foundations. Contrary to popular belief, these are not just for the ultra-wealthy or those seeking privacy. For many families, they serve as practical mechanisms for ensuring continuity and control. A trust, for example, allows assets to be transferred according to specific instructions, without going through probate, which can be lengthy and public. More importantly, it enables the grantor to set conditions on how and when beneficiaries receive funds—such as staggered distributions over time or requirements for education or financial literacy.

Insurance is another critical layer of protection. Life insurance can provide immediate liquidity to cover estate taxes or other expenses, preventing the need to sell assets under pressure. Long-term care insurance can protect the estate from being depleted by medical costs in later years. Umbrella liability policies safeguard against lawsuits that could otherwise erode wealth. These tools do not generate returns, but they prevent catastrophic losses—making them essential components of a comprehensive risk management strategy.

Contingency planning is equally important. A well-structured inheritance plan includes not only the ideal scenario but also responses to unexpected events. What happens if a beneficiary faces divorce, bankruptcy, or addiction? Provisions can be made to protect assets in such cases—such as placing funds in a discretionary trust where distributions are controlled by an independent trustee. Similarly, having a successor advisor or financial guardian in place ensures that the portfolio continues to be managed wisely even if the primary beneficiary is unable or unwilling to do so.

Ultimately, risk control is about creating resilience. It’s recognizing that wealth is not just a number on a statement, but a system that must be protected from both external shocks and internal weaknesses. By combining financial safeguards with legal and human-centered design, families can build an inheritance that is not only valuable but durable.

Practical Steps: Turning Theory into Action

Understanding the principles of smart inheritance planning is one thing; implementing them is another. Many families delay action because the process seems overwhelming or because they assume it’s only for the very wealthy. But the truth is, every estate—regardless of size—can benefit from thoughtful organization and proactive management.

The first step is a comprehensive review of current assets. This includes not just financial accounts, but real estate, business interests, insurance policies, and personal property. The goal is to create a clear picture of what exists, how it is titled, and how it is performing. From there, it’s possible to identify concentration risks—such as having more than 20-30% of net worth tied to a single investment or property.

Once risks are identified, the next phase is gradual rebalancing. This doesn’t mean selling everything at once. A sudden, large-scale shift can trigger tax consequences or market timing risks. Instead, the transition should be phased over time. For example, as certain assets mature or generate gains, those proceeds can be redirected into more diversified holdings. New contributions to the portfolio can also be allocated according to the target mix from the outset.

Professional guidance is invaluable at this stage. A qualified financial advisor, estate planner, or tax professional can help navigate legal and regulatory considerations, optimize tax efficiency, and ensure that the plan aligns with both financial goals and family values. Their role is not to take control, but to provide clarity and structure—helping the family make informed decisions with confidence.

Equally important is communication. Too often, inheritance plans are created in secrecy, only to be revealed after the fact. This can lead to confusion, resentment, or even legal challenges. A better approach is to involve key beneficiaries in the process—sharing the rationale behind decisions, explaining the structure of the plan, and setting expectations early. These conversations don’t have to be technical; they can focus on values, responsibilities, and the purpose of the wealth. When heirs understand the intent behind the plan, they are more likely to respect and uphold it.

The Emotional Side of Passing Wealth: Clarity Over Conflict

Money has a way of amplifying emotions. Even in close families, the transfer of wealth can trigger jealousy, misunderstanding, or unspoken expectations. Siblings may feel that one is favored over another. Adult children may feel entitled to immediate access, while parents wish to ensure long-term security. Without clear communication, even the best financial plan can unravel in the face of human dynamics.

The key to preventing conflict is transparency. This does not mean revealing every detail of account balances or investment choices, but it does mean explaining the overall structure and intent. When beneficiaries understand that a trust is designed to protect them—not to control them—they are more likely to accept its terms. When they know that staggered distributions are meant to support education or homeownership, rather than withhold funds, they are less likely to feel slighted.

Documentation plays a critical role. A well-drafted letter of intent, separate from the legal will, can express personal values, hopes, and wishes. It can explain why certain decisions were made—why a charity was included, why a particular heir received a specific asset, or why equal distribution wasn’t chosen. These explanations, written in a personal voice, can go a long way in preserving family harmony.

Timing matters, too. Conversations about inheritance should not wait until a health crisis or death. Starting early—while the parent or grantor is healthy and in control—allows for dialogue, questions, and even feedback. It turns inheritance from a transaction into a shared journey. Workshops, family meetings, or educational sessions on financial literacy can further empower heirs, giving them the tools they need to manage wealth responsibly.

Ultimately, the goal is not just to pass on money, but to pass on wisdom. When financial planning is paired with emotional intelligence, inheritance becomes a force for unity, not division. It becomes a legacy of clarity, care, and continuity.

Building a Legacy That Lasts Beyond a Lifetime

True wealth is not measured by the size of an account balance, but by its ability to endure. A legacy that lasts is not built on maximum returns or aggressive speculation, but on thoughtful, disciplined planning that prioritizes preservation, protection, and purpose. The strategies outlined—diversification, risk control, legal structuring, and open communication—are not isolated tactics; they are interconnected elements of a resilient financial ecosystem.

For families, the reward is not just financial security, but peace of mind. Knowing that wealth will not vanish in a generation, that heirs will be supported without being spoiled, and that values will be honored alongside assets—this is the real measure of success. It means creating freedom: the freedom for future generations to pursue their goals without financial fear, and the freedom for the current generation to let go with confidence.

The journey of inheritance planning is not a one-time event, but an ongoing process. It evolves as families grow, markets change, and goals shift. But the foundation remains the same: a commitment to protecting what has been built, and a vision for what it can become. When wealth is managed with care, it does more than survive—it serves. It educates, it empowers, and it uplifts. And in the end, that is the mark of a legacy truly worth passing on.