How I Survived a Debt Crisis — What Cost Analysis Taught Me

I never thought I’d be drowning in debt — until I was. It crept up silently, disguised as convenience. When I finally faced the numbers, I realized I didn’t understand my own spending. Small daily choices — online shopping, subscription renewals, dining out just to save time — had accumulated into a burden that felt impossible to escape. The moment of truth came on a quiet Tuesday night, staring at a stack of statements, heart sinking as I added up the minimum payments. This is the story of how I clawed back control, not with magic fixes, but by breaking down real costs. I didn’t get rich. I didn’t win the lottery. I simply learned to see money differently. If you're overwhelmed, this deep dive might be the clarity you need.

Hitting the Wall: The Moment I Realized I Was in a Debt Crisis

There was no single event that signaled the crisis — only a slow erosion of confidence. At first, credit cards felt like a safety net. A broken appliance? Put it on the card. A family emergency? Charge it and deal with it later. But over time, the net became a trap. The turning point came when I opened a credit card statement and felt physical dread. The balance was more than I earned in two months. Worse, the minimum payment barely covered interest. I wasn’t reducing debt — I was feeding it.

Emotionally, the weight was crushing. I started avoiding my mailbox. I ignored calls from unknown numbers. Every financial decision, no matter how small, came with anxiety. Would this purchase push me further into the hole? Could I afford the next grocery run without using credit? The fear wasn’t just about money — it was about losing control. I had always considered myself responsible, but now I questioned every past choice. This wasn’t just poor budgeting; it was a breakdown in awareness. I was spending without understanding the full cost of each decision.

What made the situation worse was how normal it seemed. Friends talked about credit card rewards, not repayment timelines. Social media celebrated shopping hauls and instant gratification. Lifestyle inflation had quietly taken over — as my income grew, so did my spending, without a corresponding increase in savings or debt reduction. Emotional spending became a routine coping mechanism. After a stressful day, a quick online order provided temporary relief. But the relief was always followed by guilt, and the cycle repeated. The debt crisis wasn’t just financial — it was behavioral, psychological, and deeply personal.

What Cost Analysis Really Means — And Why It’s Not Just Budgeting

When I first tried to fix things, I turned to budgeting. I downloaded apps, categorized expenses, and set limits. But the numbers still didn’t add up. I was tracking every dollar, yet the debt kept growing. That’s when I realized: tracking spending isn’t the same as understanding cost. Budgeting tells you what you spent. Cost analysis asks why, when, and at what long-term price. It’s the difference between knowing you spent $400 on a car payment and realizing that same $400, invested over ten years, could have grown to over $6,000 at a modest 7% return.

Cost analysis shifts the focus from immediate outflows to future impact. It forces you to evaluate trade-offs. For example, choosing to finance a new car isn’t just about monthly payments — it’s about depreciation, insurance costs, maintenance, and the interest paid over time. A $30,000 car might cost closer to $45,000 over five years when all factors are considered. Compare that to keeping a reliable used car and investing the difference. The upfront cost is lower, but the long-term savings are substantial. This kind of thinking transforms financial decisions from emotional reactions into strategic choices.

Another key difference is timing. Budgeting is often reactive — you review spending at the end of the month. Cost analysis is proactive. It involves asking questions before spending: Will this purchase create ongoing costs? Does it align with my long-term goals? What am I giving up by making this choice? For instance, subscribing to three streaming services might seem harmless, but over five years, that’s nearly $1,000 — money that could have gone toward a vacation, home repair, or emergency fund. Cost analysis reveals the hidden opportunity cost of everyday decisions, making it a far more powerful tool than budgeting alone.

The Hidden Costs No One Talks About (But Everyone Pays)

Most people think of debt cost in terms of interest rates and late fees. But there are deeper, less visible costs that do even more damage. The first is opportunity cost — the value of what you lose by choosing one path over another. Every dollar spent on high-interest debt is a dollar not invested. Over time, this gap widens. If you carry $10,000 in credit card debt at 18% interest, you’re paying $1,800 a year just to maintain the balance. That same $1,800, invested annually, could grow to over $150,000 in 30 years. The true cost of debt isn’t just what you pay — it’s what you miss.

Then there’s the stress tax — the mental and physical toll of financial strain. Chronic money stress has been linked to sleep disorders, high blood pressure, and weakened immune function. It affects relationships, job performance, and overall quality of life. This isn’t just anecdotal; studies show that financial worry is one of the top sources of anxiety for adults. The stress tax isn’t measured in dollars, but it extracts a real price. It clouds judgment, leads to impulsive decisions, and reduces your ability to plan for the future. In this way, debt doesn’t just drain your bank account — it drains your energy and focus.

Another silent cost is decision fatigue. When you’re constantly juggling bills, every financial choice becomes exhausting. Should I pay the credit card or the medical bill? Can I afford groceries and still make a debt payment? These constant trade-offs wear down your mental resilience. Over time, you may start avoiding decisions altogether, leading to inaction or poor choices. This fatigue makes it harder to stick to a repayment plan or adopt healthier financial habits. Recognizing these hidden costs changed my perspective. Paying off debt wasn’t just about numbers — it was about reclaiming peace of mind, time, and freedom to make better choices.

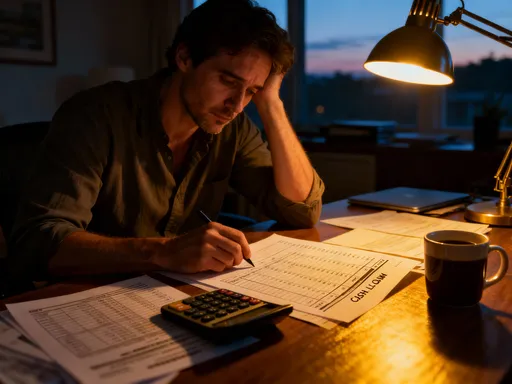

Mapping the Debt: A Step-by-Step Breakdown of My Liabilities

Before I could create a plan, I needed a clear picture of what I owed. This wasn’t just about listing balances. I created a detailed spreadsheet that included every debt: credit cards, medical bills, personal loans, and even informal IOUs to family. For each, I recorded the current balance, interest rate, minimum payment, and due date. But I went further — I also noted the emotional weight of each debt. Some felt urgent because of collection threats. Others carried guilt because they were spent on non-essentials. This emotional dimension was just as important as the numbers.

I grouped my debts into three categories: high-interest, high-stress, and long-term. High-interest debts, like credit cards at 19% or more, were clear priorities due to their cost impact. High-stress debts were those causing anxiety, even if the balance was small. A $500 medical bill with aggressive collection calls, for example, affected my mental health more than a larger, lower-interest loan. Long-term debts, like personal loans with fixed payments, were less urgent but still part of the overall picture. This categorization helped me see debt not as a single monster, but as a collection of problems with different characteristics.

Next, I analyzed the payoff timeline for each debt under minimum payments. The results were sobering. A $7,000 credit card balance at 17% interest would take over 14 years to pay off if I only made minimum payments — and I’d pay nearly $8,000 in interest. That meant doubling the original cost. Seeing this in writing was a wake-up call. It showed me that doing nothing was the most expensive choice of all. With this map in hand, I could start prioritizing not just by interest rate, but by psychological relief and long-term cost. The goal was to reduce both the financial burden and the mental load as quickly as possible.

The Payoff Playbook: Strategies That Actually Worked

I tested several repayment methods, and not all worked for me. The first was the avalanche method — paying off debts with the highest interest rates first while making minimum payments on the rest. In theory, this saves the most money. And it did — I reduced total interest paid by over 30% compared to minimum-only payments. But emotionally, progress felt slow. I was focused on the largest, highest-rate debt, which took months to pay down. The lack of quick wins made it hard to stay motivated. I realized that while the avalanche method is mathematically optimal, it doesn’t account for human psychology.

So I switched to the snowball method — paying off the smallest balances first, regardless of interest rate. This changed everything. Within two months, I paid off three small debts. Each payoff gave me a sense of accomplishment. That momentum kept me going. Yes, I paid more in interest overall, but the emotional boost was worth it. I stayed consistent, and consistency is what ultimately leads to results. The snowball method taught me that financial success isn’t just about efficiency — it’s about sustainability. If a strategy keeps you engaged, it’s working, even if it’s not the most optimal on paper.

I also explored balance transfers and debt consolidation. A 0% introductory rate on a balance transfer card helped me pause interest on one $4,000 card for 15 months. That gave me breathing room to focus on other debts. But I had to be careful — the rate jumped to 19% after the promo period, and there was a 3% transfer fee. I paid off the full balance before the rate changed, but it required discipline. I also negotiated with one credit card issuer and got my interest rate reduced by 4 percentage points. That single call saved me over $1,200 in projected interest. These tools weren’t magic, but used wisely, they made a real difference.

Protecting Gains: How I Built a Buffer to Avoid Repeating Mistakes

Once I started making progress, I knew I couldn’t go back to old habits. The real test wasn’t paying off debt — it was staying out of it. I shifted from crisis mode to prevention mode. The first step was building a small emergency fund. I started with $500, then $1,000. This wasn’t about comfort — it was about risk control. Before, any unexpected expense sent me back to credit cards. Now, a flat tire or medical co-pay didn’t derail my progress. The emergency fund became my financial shock absorber.

I also reevaluated every recurring expense. I canceled two streaming services I rarely used, switched to a cheaper phone plan, and stopped automatic renewals for software I didn’t need. These changes saved over $100 a month — money I redirected toward savings and debt repayment. I adopted a 48-hour rule for non-essential purchases: if I wanted something, I waited two days before buying. Most of the time, the urge passed. This simple habit broke the cycle of emotional spending.

More importantly, I developed a cost-conscious mindset. Every purchase came with a mental checklist: Do I really need this? What are the long-term costs? What am I giving up? This wasn’t about deprivation — it was about intention. I still enjoyed life, but I did so with awareness. I planned meals to reduce food waste, bought quality items that lasted longer, and prioritized experiences over things. These habits weren’t temporary fixes; they became part of my identity. Financial health wasn’t a goal — it was a way of living.

From Crisis to Control: Turning Cost Analysis Into a Financial Compass

What started as a survival tactic became a lifelong framework. Cost analysis is now my default lens for every financial decision. When I consider a job change, I don’t just look at salary — I analyze commute costs, time investment, and long-term growth potential. When I shop, I think about total cost of ownership, not just the sticker price. This mindset has helped me avoid new debt, grow savings, and make smarter investments. More than that, it’s given me confidence. I no longer feel at the mercy of my finances.

Cost analysis also supports long-term wealth building. By understanding trade-offs, I’ve been able to redirect money toward retirement accounts, low-cost index funds, and home improvements that increase value. I don’t chase get-rich-quick schemes. I focus on steady, informed decisions that compound over time. The same discipline that helped me escape debt now helps me build assets. I’ve learned that financial freedom isn’t about having a lot of money — it’s about having control over how it’s used.

This journey reshaped my relationship with money. It’s no longer a source of shame or stress. It’s a tool — one that requires respect, attention, and strategy. I share this not as an expert, but as someone who’s been on the other side of panic and come out stronger. The lessons I learned aren’t complicated, but they are powerful. They’re available to anyone willing to look closely at their spending, face the real costs, and make intentional choices. That clarity is the foundation of financial resilience.

What started as a desperate attempt to survive debt became a powerful framework for smarter decisions. Cost analysis didn’t just help me escape — it taught me how to think differently. The real win wasn’t paying off balances; it was gaining clarity. I learned that every dollar carries weight, every choice has consequences, and every small decision shapes the bigger picture. If you're in crisis, remember: understanding cost is the first step toward control. You don’t need a windfall. You don’t need perfect discipline. You just need to start seeing money for what it really is — not just a number in an account, but a reflection of your values, choices, and future. With that awareness, you can move from surviving to thriving. One clear decision at a time.