Why Risk Assessment Changed My Investment Game – A Smarter Way to Protect Your Money

What if the key to growing your wealth isn’t just about picking winners, but avoiding costly mistakes? I used to chase high returns—until I took a serious hit. That’s when I realized: real financial progress starts with understanding risk. This is how I shifted from guessing to assessing, protecting my portfolio, and making smarter moves without stress or sleepless nights. For years, I believed that success in investing meant finding the next big thing—the stock that would double, the fund with the highest yield, the trend everyone was talking about. But that mindset nearly cost me everything. It wasn’t a market crash that scared me most; it was realizing how little I truly understood about the risks I had taken. Since then, I’ve rebuilt my approach from the ground up, placing risk assessment at the center of every decision. And the difference has been transformational.

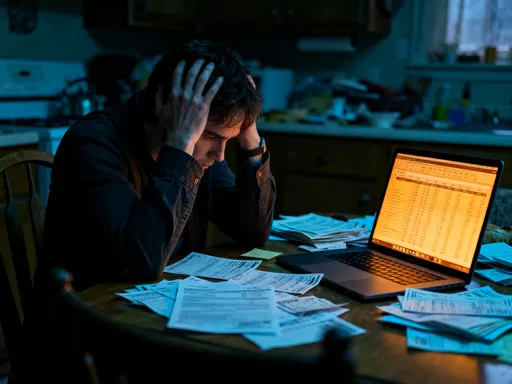

The Wake-Up Call: When My Portfolio Took a Hit

There was a time when I thought I had investing figured out. I was making consistent gains, reading financial news daily, and feeling confident in my choices. I had put a significant portion of my savings into a single technology stock that was gaining momentum. Analysts were bullish, media coverage was glowing, and early returns were impressive. I told myself I was being smart—riding a wave of innovation. But I hadn’t asked the hard questions: What if the company’s revenue model wasn’t sustainable? What if competition increased faster than expected? What if market sentiment shifted overnight? I didn’t stress-test the investment, nor did I consider how much of my portfolio was exposed to one sector. When the stock dropped 40% over a few months due to regulatory concerns and slower-than-expected growth, I watched helplessly as years of compounded gains eroded.

The financial loss was painful, but the emotional toll was worse. I began questioning every other investment I held. Was I just lucky before? Had I been ignoring red flags across my entire portfolio? That experience shook my confidence and forced me to confront an uncomfortable truth: I wasn’t managing my money—I was reacting to it. I had mistaken momentum for safety and popularity for stability. The reality was that I had no structured way to evaluate what I was getting into. I had no clear understanding of my own risk tolerance, and I certainly wasn’t measuring the actual risk in my holdings. That single loss became a turning point. Instead of doubling down on aggressive bets to recover, I decided to step back and learn how to invest with intention, not impulse. I began studying how seasoned investors protect their capital, and one concept kept appearing: risk assessment.

What Risk Assessment Really Means (Beyond the Buzzwords)

Risk assessment is often discussed in broad, abstract terms—something that financial advisors mention in meetings but rarely explain in practical detail. Many people assume it’s just another way of saying “be careful” or “don’t invest too much.” But in reality, risk assessment is a disciplined process of understanding what could go wrong, how likely it is, and what the consequences would be. It’s not about avoiding risk altogether—that’s impossible in investing—but about making informed decisions based on a clear-eyed view of potential downsides. Think of it like a routine medical checkup. You don’t go to the doctor only when you’re sick; you go to catch problems early, to understand your current health, and to make lifestyle adjustments before issues become serious. Similarly, financial risk assessment helps you identify vulnerabilities before they lead to significant losses.

At its core, risk assessment involves three key steps: identifying risks, measuring exposure, and planning responses. First, you ask what could go wrong—market volatility, company-specific issues, economic downturns, or personal life changes like job loss or health issues. Second, you evaluate how much of your portfolio is affected by each risk and how much loss you could realistically withstand. Third, you create a plan: under what conditions would you exit an investment? How much of your savings should remain liquid? What safeguards can you put in place to reduce exposure? This process transforms investing from a game of chance into a structured, thoughtful practice. It’s not driven by fear, but by clarity. When you assess risk properly, you’re not paralyzed by uncertainty—you’re empowered by knowledge. You stop asking, “Will this investment go up?” and start asking, “What happens if it goes down, and can I live with that?” That shift in mindset is where real financial control begins.

The Hidden Gaps in Common Investment Strategies

Many widely promoted investment strategies sound smart on the surface but fall short when it comes to risk evaluation. Take diversification, for example. It’s often presented as a one-size-fits-all solution: “Don’t put all your eggs in one basket.” While diversification is a valuable principle, it’s not automatically effective. I once believed that spreading my money across ten different funds made me safe. But when I looked closer, I realized most of those funds were heavily invested in the same sectors—technology and consumer discretionary. When the market corrected, nearly all my holdings dropped together. True diversification isn’t just about owning multiple assets; it’s about owning assets that respond differently to market conditions. Without assessing correlation and concentration risk, diversification can give a false sense of security.

Another popular approach is the “set-and-forget” portfolio, often marketed as a hands-off, long-term strategy. The idea is appealing: pick a mix of index funds, contribute regularly, and let compounding do the work. While this method works for many, it assumes stable markets and consistent personal circumstances. I tried it for a few years, but when my financial goals shifted—planning for early retirement and funding my child’s education—I realized my portfolio wasn’t aligned with my changing needs. I hadn’t reassessed my risk exposure as my time horizon shortened. Additionally, chasing trends is another common trap. When cryptocurrency surged in popularity, I was tempted to invest a large sum based on hype. I didn’t evaluate the technology, regulatory risks, or volatility. Fortunately, I held back after doing a simple risk check, and later saw many early adopters lose significant amounts when the market corrected. These experiences taught me that even strategies labeled as “safe” or “passive” require active risk evaluation.

Building a Personal Risk Framework: What Works for Me

After my setbacks, I knew I needed a personalized system—not a generic formula, but a flexible framework that reflected my life, goals, and emotional comfort level. I started by defining three pillars: risk tolerance, time horizon, and financial objectives. Risk tolerance isn’t just about how much money I can afford to lose; it’s also about how I react emotionally to losses. I used a simple questionnaire to assess whether I was conservative, moderate, or aggressive, but I also reflected on past decisions. How did I feel when my portfolio dipped 10%? Did I panic, or stay calm? That self-awareness helped me align my investments with my true comfort zone, not just my ambitions.

Next, I mapped my time horizon. Some of my goals, like retirement, were decades away, allowing for more growth-oriented investments. Others, like saving for a home renovation, were short-term, requiring capital preservation. I created separate buckets for each goal and assigned appropriate risk levels. Finally, I clarified my financial objectives: not just growing wealth, but protecting it, ensuring liquidity, and supporting my family’s stability. With these three elements in place, I developed a decision filter. Before making any investment, I ask: Does this align with my risk tolerance? Does it fit my time horizon? Does it serve a specific goal? If the answer to any is no, I don’t proceed. This framework isn’t rigid—it evolves as my life changes. When I took a career break, I adjusted my exposure. When my child started college, I shifted more assets to low-volatility options. The power of this system is that it removes emotion from decision-making. It gives me permission to say no, even to seemingly attractive opportunities, because I know what I’m protecting is more valuable than what I might gain.

Tools That Make Risk Assessment Practical (Not Overwhelming)

One of my biggest concerns when starting this journey was complexity. I didn’t have a finance degree or access to advanced software. But I discovered that effective risk assessment doesn’t require sophisticated tools—just consistent, simple practices. I began with a basic spreadsheet to track my portfolio. Instead of just listing holdings and values, I added columns for risk factors: sector exposure, geographic concentration, volatility rating, and correlation to the broader market. This gave me a visual map of where I might be overexposed. I also started using scenario analysis—what if the market drops 20%? How would my portfolio perform? I estimated worst-case outcomes based on historical data and stress-tested my allocations.

Another tool I rely on is a checklist, modeled after those used in aviation and medicine. Before buying or selling any investment, I go through a list of questions: Have I reviewed the fundamentals? Is this aligned with my goals? What are the potential downside scenarios? Do I have enough liquidity to handle unexpected expenses? This checklist prevents impulsive decisions and ensures I consider risk every time. I also set up automatic alerts for major market shifts or news related to my holdings. These notifications prompt me to review positions before small issues become big problems. Additionally, I use online calculators to estimate drawdowns and recovery periods. For example, a 30% loss requires a 43% gain just to break even—seeing that number in black and white made me more cautious about aggressive bets. These tools aren’t perfect, but they create structure. They turn risk assessment from an abstract idea into a repeatable habit.

How Risk Control Actually Boosts Long-Term Gains

One of the most surprising lessons I’ve learned is that protecting capital often leads to better long-term returns than chasing high-risk opportunities. It sounds counterintuitive, but the math supports it. When you avoid large losses, you don’t have to climb out of deep holes. A portfolio that loses 50% needs to gain 100% just to return to its original value. By contrast, a portfolio that limits losses to 15% only needs an 18% gain to recover. Over time, this compounding advantage adds up. Since adopting risk-aware investing, my annual returns haven’t been the highest they’ve ever been—but my net growth has been more consistent, and I’ve preserved far more wealth during downturns.

I’ve also found that risk control creates better reinvestment opportunities. When the market corrects, many investors are too stressed or undercapitalized to act. But because I’ve preserved liquidity and avoided overexposure, I’ve been able to buy quality assets at discounted prices. These strategic purchases have contributed significantly to my long-term gains. Additionally, by cutting losing positions early—before they become major drains—I’ve freed up capital to redeploy into more promising areas. This disciplined approach has reduced emotional fatigue, allowing me to stay focused and patient. I’m no longer chasing short-term wins or reacting to market noise. Instead, I’m building wealth gradually, with confidence. The result? My portfolio has grown at a steadier pace, with fewer setbacks, and I sleep better at night knowing I’m not one bad decision away from starting over.

Making Risk Awareness a Habit, Not a Chore

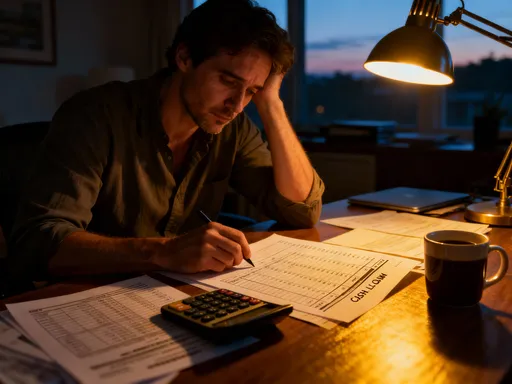

The final piece of my transformation was turning risk assessment from a one-time project into an ongoing practice. I schedule quarterly portfolio reviews, during which I reassess my goals, update my risk framework, and run through my checklist. These sessions take a few hours, but they prevent complacency. I also review major life changes—new income sources, family needs, or health considerations—and adjust my investments accordingly. Over time, this has become as routine as paying bills or planning a family budget. I’ve also shared parts of my process with my spouse, so we’re aligned on financial priorities and can support each other in staying disciplined.

Another habit I’ve built is regular education. I read books, listen to trusted financial podcasts, and follow reputable analysts—not to find hot tips, but to deepen my understanding of risk. This continuous learning keeps me humble and aware of blind spots. I’ve also learned to celebrate small wins: sticking to my plan during a market dip, avoiding a speculative trend, or simply completing a review on time. These moments reinforce the value of discipline. Most importantly, I’ve accepted that perfection isn’t the goal. I’ve made mistakes even with my system, but the key difference is that now I catch them sooner and recover faster. Risk awareness isn’t about eliminating uncertainty—it’s about building resilience. And that resilience has become the most valuable asset in my financial life.

Smarter, Not Riskier—The Real Path to Financial Confidence

Looking back, my biggest financial upgrade wasn’t a new investment strategy, a higher return, or a lucky stock pick. It was a fundamental shift in mindset—from chasing gains to protecting value. I used to believe that success meant taking bold risks. Now I know that lasting success comes from understanding those risks and making intentional choices. Risk assessment hasn’t made me risk-averse; it’s made me risk-aware. It’s given me the clarity to invest with confidence, the discipline to avoid emotional decisions, and the peace of mind that comes from knowing I’m prepared for what might go wrong.

This approach isn’t flashy, and it won’t make headlines. But it’s sustainable, practical, and deeply empowering. It’s allowed me to grow my wealth without sacrificing my well-being or security. For anyone who has ever felt overwhelmed by market noise, tempted by trends, or shaken by losses, I offer this: take the time to understand your risks. Build a framework that reflects your life. Use simple tools to stay consistent. And remember, the goal isn’t to get rich quickly—it’s to stay rich steadily. Financial confidence doesn’t come from the size of your portfolio, but from the strength of your process. And that, more than any single investment, is the true foundation of lasting financial health.